July 10, 2025

Unlocking Sales Potential: Leveraging Modern Payment Solutions for RGV Businesses

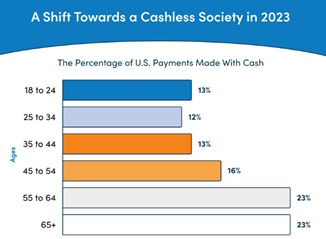

We live in a fast-paced digital world, and for businesses, offering modern payment methods is no longer a luxury but a necessity. Cash payments account for only 16% of all transactions, and businesses in the RGV must adapt to stay competitive. The digital approach to payment reflects the shift toward a cashless society, particularly among the upcoming youth, who have risen from 24% in 2015 to 48% in 2024.

The Shift Toward Digital Payments in the RGV

The payment landscape in the Rio Grande Valley (RGV) is evolving with the rest of the world, mirroring national trends toward digital transactions.

- 92% of U.S. consumers used a digital payment method last year.

- 80% of small businesses that adopted digital payments saw revenue growth.

What are modern payment solutions?

- Mobile Wallets (Apple Pay, Google Pay)

- Contactless Payments (Tap-to-pay credit/debit cards)

- Digital Banking Products

- Real-Time Payment Systems (Zelle, Venmo, PayPal)

These technologies enhance customer experience, improve security, and boost revenue. Let’s explore the key benefits of adopting these payment methods in your RGV business.

Contactless payments have gained popularity due to their speed and convenience. They reduce transaction time and minimize physical contact, a crucial consideration in today’s health-conscious environment. Digital wallets like Apple Pay and Google Pay further enhance security through advanced encryption and biometric authentication.

Why RGV Businesses Must Embrace Modern Payments

Businesses that implement digital payment methods experience increased efficiency and customer satisfaction.

Comparison: Traditional vs. Modern Payment Methods

| Feature | Traditional Methods | Modern Solutions |

| Transaction Speed | Slower | Faster |

| Security | Basic | Advanced (encryption, tokenization) |

| Customer Experience | Variable | Seamless and convenient |

| Integration | Limited | Easily integrates with accounting and CRM software |

- Faster Payments = Increased Sales

Contactless payments can reduce transaction times by up to 50%, meaning quicker checkouts and happier customers.

- Improved Security Reduces Fraud

Digital wallets like Apple Pay and Google Pay use encryption and biometric authentication, lowering fraud risk. - Customer Preferences Drive Revenue Growth56% of consumers avoid businesses that don’t accept card or digital payments.42% of small business owners say digital payments help attract new customers.

Providing customers the flexibility to pay how they want helps businesses get paid faster, retain customers, and ultimately grow. By embracing these innovative payment solutions, RGV businesses can position themselves for success in an increasingly digital marketplace.

Key Advantages of Digital Payments for Your Business

- Faster Transactions: Reduces checkout time, leading to higher customer satisfaction.

- Higher Sales: Multiple payment options encourage impulse purchases and repeat business.

- Stronger Security: Protects against fraud with encryption and biometric authentication.

- Better Financial Tracking: Integrates with accounting software for real-time data analysis.

- Global Reach: Accepts multiple currencies, expanding your customer base internationally.

How to Implement Modern Payment Solutions in Your RGV Business

Transitioning to modern payment solutions is crucial for RGV businesses to stay competitive in today’s digital marketplace. It is not a difficult process, and you can find the necessary advice and guidelines from experts. Follow these step to move your business into the competitive digital world:

- Step 1: Assess Your Current Payment System

Evaluate your existing methods and identify areas for improvement. - Step 2: Choose the Right Payment Options

Consider your business size, type, and customer demographics before selecting a payment provider. - Step 3: Ensure Seamless Integration

Look for solutions that integrate with your accounting and sales systems. - Step 4: Train Your Staff

Educate employees on how to use new systems to ensure smooth adoption. - Step 5: Address Security Concerns

Use providers that offer encryption, tokenization, and fraud protection.

Implementing new systems gradually and providing thorough training for staff can help overcome common challenges such as technical difficulties and resistance to change.

Stay ahead: Upgrade your payment solutions today

Modern payment solutions are no longer optional but essential for staying competitive. Whether you run a small startup or a growing enterprise in the Rio Grande Valley, digital payments can help you streamline operations, enhance customer satisfaction, and drive sales growth.

Unlock your sales potential today with modern payment solutions. Contact Greater State Bank to learn how we can help you transition to secure, efficient, and flexible payment options to transform your business.