March 18, 2025

How to Keep Your Online Banking Identity Safe with Greater State Bank

Banking has evolved from queuing in lines to deposit or withdraw money, to the convenience of doing everything at home on your laptop or phone. Today’s online banking puts financial transactions just a few taps away, allowing customers to manage their finances anytime, anywhere. This evolution has been driven by rapid technological advancements, particularly the widespread adoption of smartphones throughout the Rio Grande Valley.

What is Online Banking?

Online banking allows customers to access financial services through websites and mobile apps. Since the 1990s, digital banking has evolved from basic account viewing to full financial management platforms.

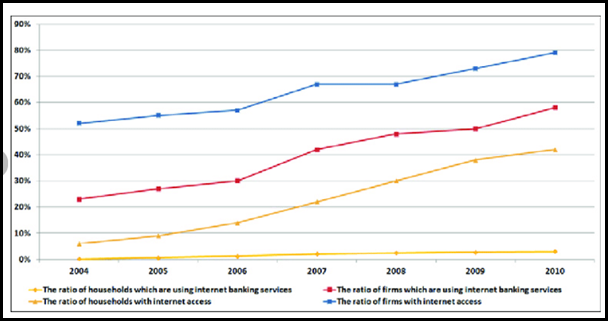

Online Banking growth

- 57% of banking customers say online access is among their most essential banking services.

- 54% prioritize mobile app availability.

Fraud in Online Banking

Unfortunately, online banking is a target for scammers and fraudsters, and we have all heard of people who have lost money to online fraud.

Interestingly, proper use of online banking can enhance financial security, as customers can detect unauthorized transactions more quickly than with traditional banking methods, allowing for immediate intervention.

We will walk you through the process of registering for online banking in the RGV and explain what precautions you can take to prevent your digital identity from being stolen and you from becoming a victim of online fraud.

How to Register for Online Banking with Greater State Bank

To register for Greater State Bank’s online banking, follow these steps:

1. Go to Greater State Bank’s official website or mobile app.

2. Click on ‘Register’ or ‘Enrol.’

3. Enter your account number, Social Security number, and date of birth.

4. Create a username and a strong password with special characters and numbers.

5. Set up security questions with answers that aren’t easy to find on social media.

6. Enable multi-factor authentication for added protection.

Required Documentation

When registering, keep these items handy:

- Your bank account number and routing number

- Valid government-issued ID

- Your Social Security number

- A valid email address and phone number for verification

Security Best Practices During Registration

- Register using a secure, private internet connection—never public WiFi

- Create a unique password unlike those used for other accounts

- Enable all available security features offered by your bank

- Verify that the bank’s website uses encryption (look for “https” and a lock icon)

- Be wary of emails claiming to help you complete registration—these could be phishing attempts. Contact Greater State Bank if you experience difficulties. They are at your service for help and support.

Protect Your Digital Identity

Once you have set up your online banking, you might feel vulnerable and exposed to all your personal financial information. However, your identity is just as valuable as your physical property—perhaps even more so. Protecting your identity is one of the most important things you can do to ensure your financial health. When this information falls into the wrong hands, the consequences can be devastating, ranging from stolen funds to damaged credit scores.

Fortunately, as banking evolved, so did security measures. Greater State Bank invests in advanced security measures, including:

- 24/7 fraud monitoring to detect unusual transactions.

- Biometric authentication (fingerprint and facial recognition) for secure logins.

- End-to-end encryption to protect data transfers.

What you can do to Protect Your Digital Banking Identity:

If you receive an email or text asking for your banking details, DO NOT respond. Banks will never ask for sensitive information. Pay attention to the following guidelines to protect yourself:

- Never provide personal information over email.

- Never click on any links in the email.

- Do not call any phone number in the email.

- Verify the bank’s number when receiving a call, and do not provide personal information.

- Keep your anti-virus software updated.

- Never use your email to send or receive sensitive personal information.

- Regularly monitor your accounts for suspicious activity.

- Keep your devices updated with the latest security patches and anti-virus software.

- Be wary of banking on public WiFi networks; use your cellular data instead.

Understanding the Risks – Common Cyber Threats

- Phishing scams: Fraudulent emails or texts pretending to be from your bank.

- Malware: Malicious software that can steal login credentials.

- Public WiFi risks: Hackers intercept your data on unsecured networks.

- Account takeovers: Cybercriminals gain access to accounts using stolen credentials.

What to Do If You Suspect Fraud

If you suspect fraud, act immediately:

- Call your bank immediately on their fraud hotline

- Email the bank’s security team

- Review recent transactions and report any suspicious activity

- Change your online banking password immediately

Stay Safe with Greater State Bank

Your financial security is our top priority. Stay vigilant, follow best practices, and trust Greater State Bank to protect your banking identity.